Quick & Friendly Service

“Always quick, easy and friendly service. No hidden fees. Have loved this credit union for over 20 years!”

2021 Annual Report

> Executive Summary

> Member Connections

> Workplace Culture

> Card Usage Increase

> Breaking Real Estate Records

> Supporting the Community

> What’s Next

> 2021 Financials

In 2021, Citadel Credit Union continued to prioritize new ways of connecting with members and supporting the community. We are pleased to report that our asset growth increased to $4.6 billion and our Real Estate division had a record year with over $1 billion originated in loans to help our members find comfort in new homes.

Citadel experienced continued asset growth in 2021. View our Financial Summary Report.

We invested in more ways for members to conveniently connect and transact virtually.

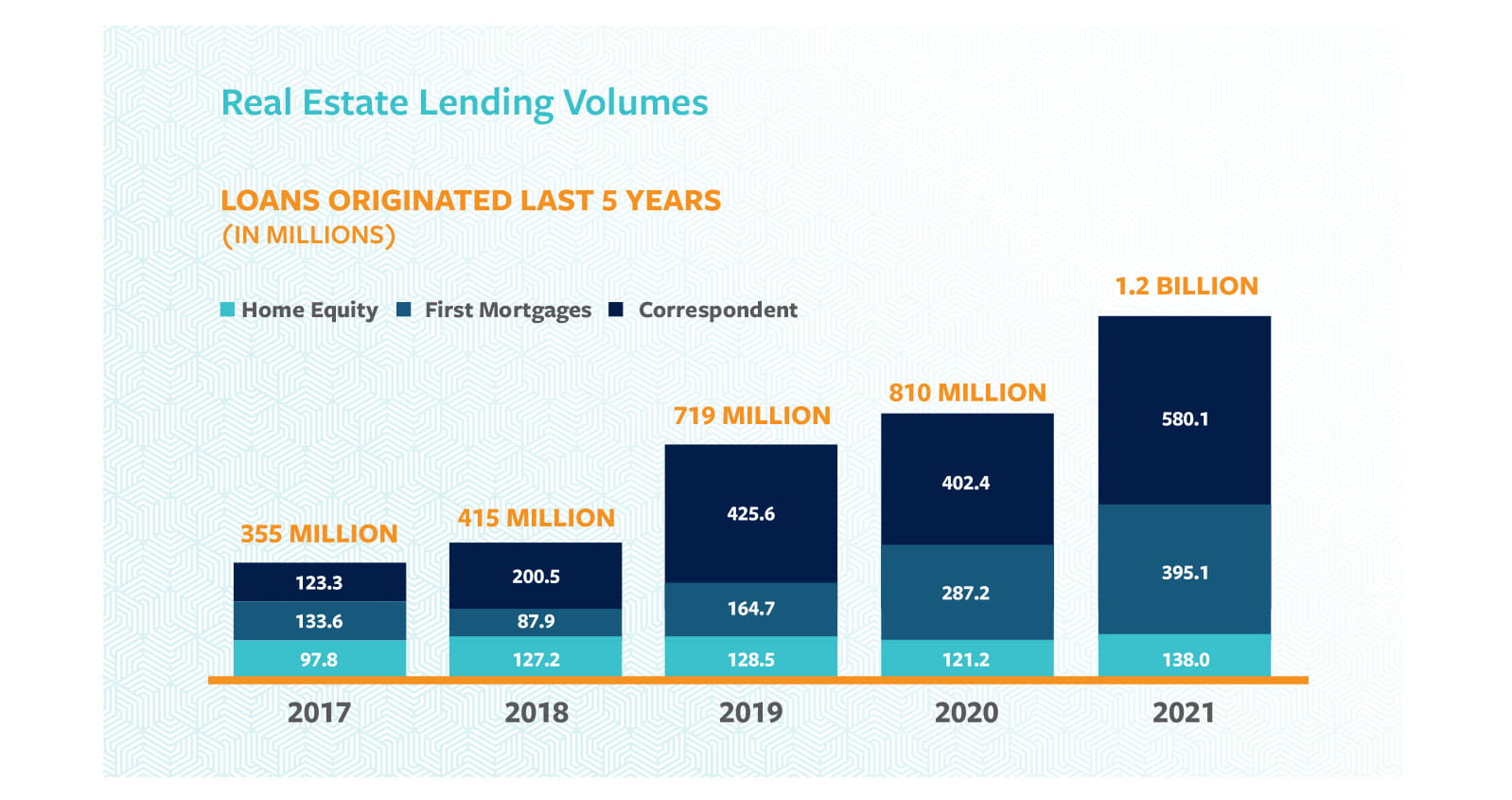

As the industry changed, our real estate lending volumes increased dramatically in 2021.

In 2021, Citadel’s assets increased $327 million to $4.6 billion—with deposits and lending growing 8 percent year-over-year. Overall, loans grew $305 million and deposits grew to $288 million. In addition, Citadel had a record year for its Real Estate division in 2021, with over $1 billion in loans. Citadel’s asset size ranks the company as the second largest in Greater Philadelphia, and 58th nationwide.

Over the past three years, Citadel’s overall asset growth was $1.3 billion. Between 2001 and 2021, Citadel experienced a 20-year cumulative annualized growth rate (CAGR) of 13 percent. Since 2005, Citadel experienced its most significant growth—over $3.6 billion in assets, as the company has expanded to serve the broader Greater Philadelphia region.

In 2021, Citadel focused on investing in more ways for members to connect and transact from anywhere. Through the launches of video banking, online appointment scheduling, and an interactive voice banking system, members were given more virtual options and ways to bank on their terms.

And, for the second consecutive year, Citadel was named a 2021 Best-in-State credit union by Forbes Magazine. The credit unions included in the list are scored based on overall customer recommendation and satisfaction, in addition to five subdimensions (trust, terms and conditions, branch services, digital services and financial advice). Overall, only 182 credit unions qualified to be on the list, out of the 5,200 credit unions nationwide.

With online appointment scheduling, members can visit our website to book an appointment to meet with a Citadel representative in-person at their convenience. After selecting the service they need, along with their preferred day, time, and location, members will receive an email confirmation and can also sign up for text alerts or conveniently reschedule or cancel the appointment online. Check it out >

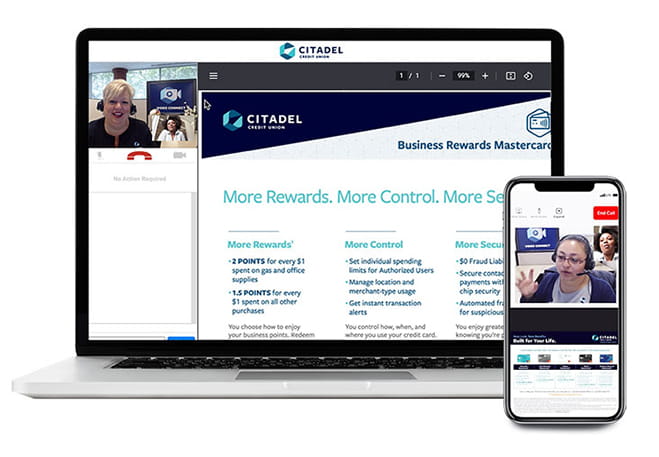

In 2021, Citadel introduced a new virtual banking option, making it easier than ever to chat face-to-face with a local Citadel representative safely and securely from anywhere. With Video Connect, members can speak directly with our team via laptop, desktop or mobile device to apply for a loan, open a new account, complete a wire transfer, and more. Learn more >

When members prefer to ask questions or conduct routine transactions over the phone, they can now turn to Voice Banking with Adel. This new voice-driven experience has replaced the traditional dial-pad menu to offer more self-service options and answers to common banking questions. When members call Citadel, Adel can help transfer funds, list account balances, make payments, and offer 24/7 account access. See what you can do >

Citadel was certified as a “Great Place to Work” in 2021 for the fourth consecutive year by the analysts at Great Place to Work, which collects and analyzes data from a survey of Citadel’s employees each year. Great Place to Work publishes national lists such as the “Fortune 100 Best Companies to Work for.”

See what employees say about what makes Citadel Credit Union a great place to work. These words are drawn from employee comments on the Trust Index™ survey. The largest words came up the most, which truly exemplifies our team's priorities and the core of our company culture.

President’s Council rewards and recognizes employees who go beyond expectations by exceeding their annual sales and service goals in a team atmosphere. We were proud to honor 33 outstanding individuals to this prestigious council in 2021.

In 2021, we had record credit card usage in addition to record sales of credit cards. It was the first full year with our suite of newly branded cards and contactless technology.

In the past two years, we all witnessed as real estate across the nation changed tremendously. Home values have soared, inventories have hit all-time lows, and folks are paying more than homes are even worth.

At Citadel, we responded by providing affordable, low rates to our members and automating much of the home loan process to speed up processing times and allow members to close quicker and easier. We also saw that many people who chose to stay in their current homes were able to save money by refinancing, or upgrade their space by taking advantage of our low-rate home equity loans and lines of credit.

As a result of these changes, Citadel’s real estate lending volumes increased dramatically in 2021, and we're proud to announce we reached $1.2 billion in loans originated, a 25% increase year-over-year.

Providing affordable lending options and partnerships with our seasoned experts will remain a top priority for Citadel moving forward as we continue to focus on building a brighter financial future for our members.

From members to employees to the community, 2021 was all about building connections. With the flexibility to connect virtually and in-person, we were able to prioritize the moments that mattered most and continue building strength together with the people around us.

In 2021, the Children’s Hospital of Philadelphia’s Parkway Run & Walk raised $1.5 million for research for a cure and care of children with pediatric cancer. Due to the pandemic, the event was once again shifted into a mileage challenge and virtual ceremony – but still was successful in bringing the community together for the betterment of our pediatric patients.

The Parkway Run epitomizes Citadel’s mission of Building Strength Together by allowing the organization to rally behind a truly impactful cause for the community.

Citadel was proud to sponsor a safe, outdoor community event that truly lifted the spirts of those who attended while raising critical funds for CHOP. For the 3rd year, Citadel Country Spirit USA took place in Glenmoore, Pennsylvania.

This nationally recognized event not only had a great economic impact on our local economy year after year of over $3 million, it also raised significant funds for Children’s Hospital of Philadelphia (CHOP). As the title sponsor, we are proud to support an event that truly provides a “great time, for a great cause.” The funds raised from this fantastic weekend celebrating music will be donated to support CHOP’s Child Life, Education and Creative Arts Therapy Program, in addition to research and life-saving treatments.

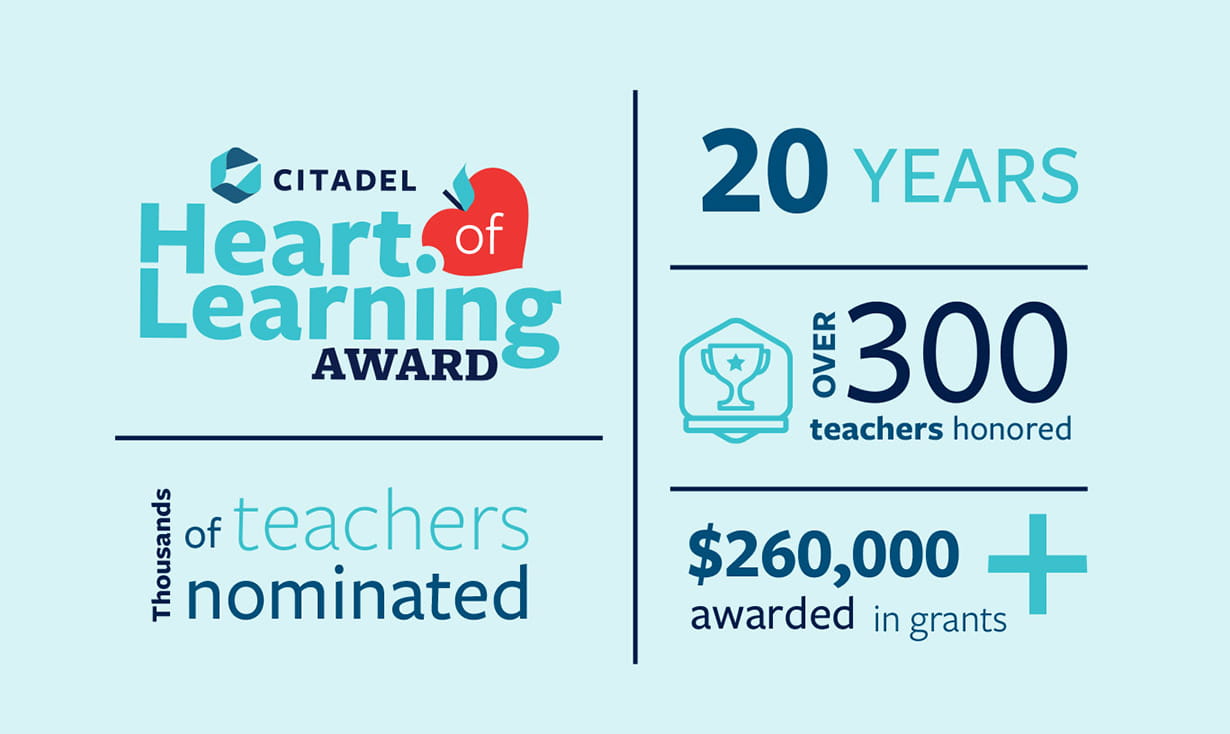

For the 20th consecutive year, Citadel honored and awarded local teachers through its Citadel Heart of Learning Award program.

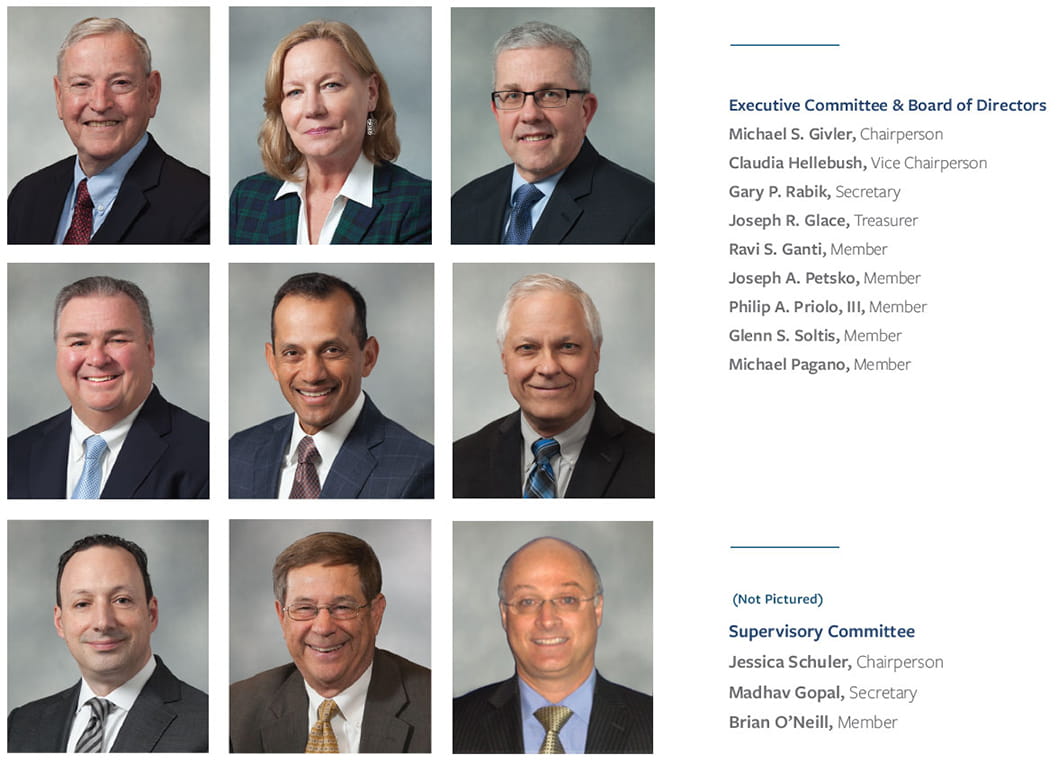

Citadel’s Supervisory Committee is composed of volunteer members who ensure that Citadel’s financial strength is fairly represented. The committee oversees the internal and external auditors who ensure the credit union is functioning within the guidelines and policies set forth by all regulatory institutions. As an organization, Citadel benefits from the diverse backgrounds of our Supervisory Committee members; we’re able to be more productive and make decisions in a sound manner.

The National Credit Union Administration (NCUA) performed an annual examination and reported that Citadel is in good financial order and in compliance with federal regulations.

At Citadel Credit Union, we are focused on serving those who work every day to build a better future for us all, including our members, employees, and local communities. Our goal is to be accessible and convenient for members and to ultimately empower those who live and work in our community, so they can prosper. As we look forward to the future, we anticipate continued innovation, success, and growth. We’ll continue to operate with the philosophy of “people helping people,” and grow at a steady, healthy pace.

As part of our commitment to growth, we will continue to invest in upgrades to our digital banking experience to increase accessibility and convenience for all members. And we will continue to prioritize new and expanded philanthropic efforts to give back to those around us.

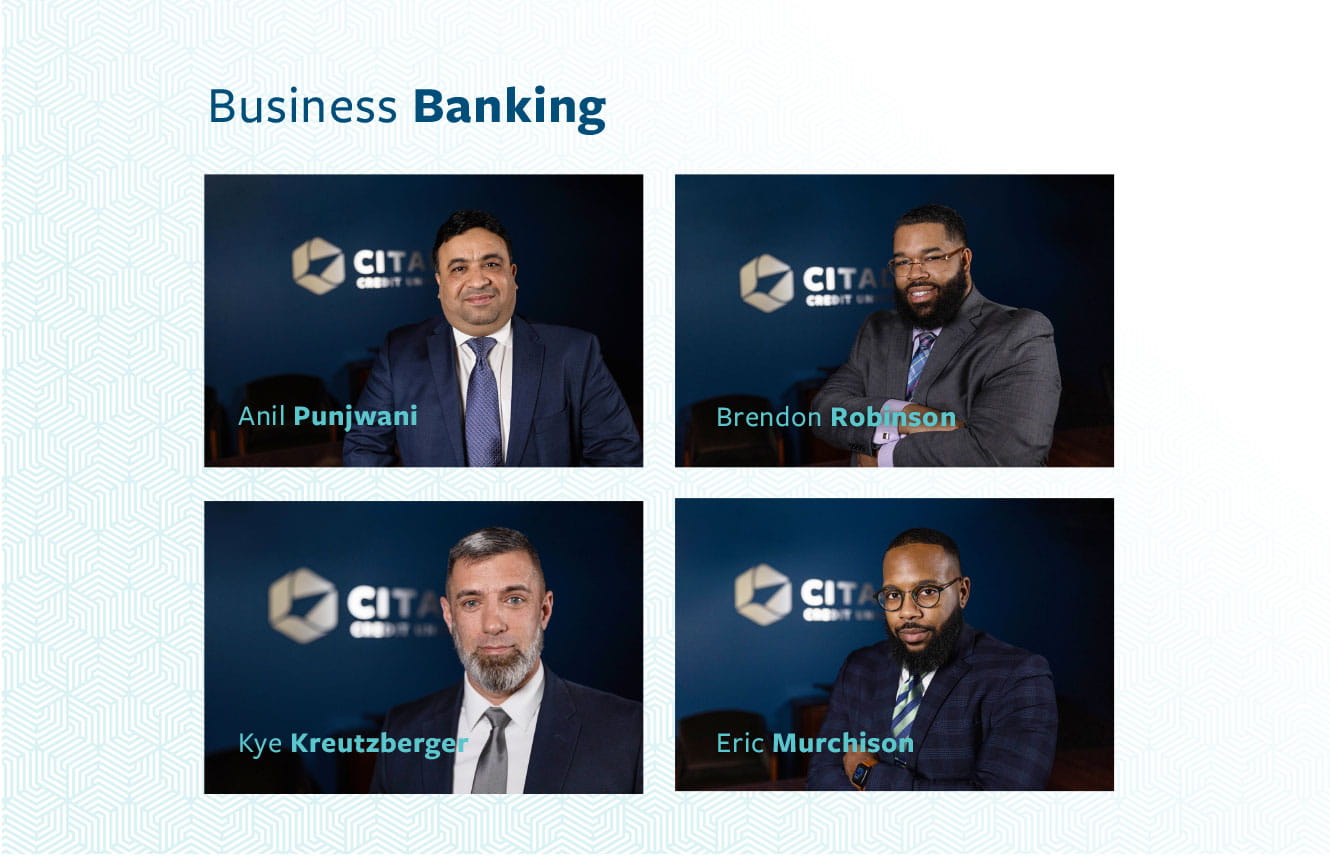

In 2022, we also look forward to launching a full suite of Business Banking products and services as a way to facilitate growth and recovery in the Greater Philadelphia area. With a new team in place, and with support from the entire organization, Citadel is uniquely positioned to support local businesses with cost-efficient products such as checking accounts, merchant services, and payroll tools.

Detailed reports including Citadel’s Statement of Financial Condition, Statement of Income, and Statement of Cash Flow can be viewed and downloaded below.

By proceeding, please note you will be leaving Citadel’s website. This linked site is not operated or monitored by Citadel Credit Union and our privacy and security policies do not apply. Citadel is not responsible for and does not endorse, guarantee or monitor content, availability, viewpoints, accuracy, products, or services that are offered or expressed on other websites.